- Prices Rise--Ready for Takeoff?

- Domestic News

- What’s New at CoinCentral?

- Cryptocurrency News from Around the World

This Week in Cryptocurrency–March 2nd, 2018

Prices Rise–Ready for Takeoff?

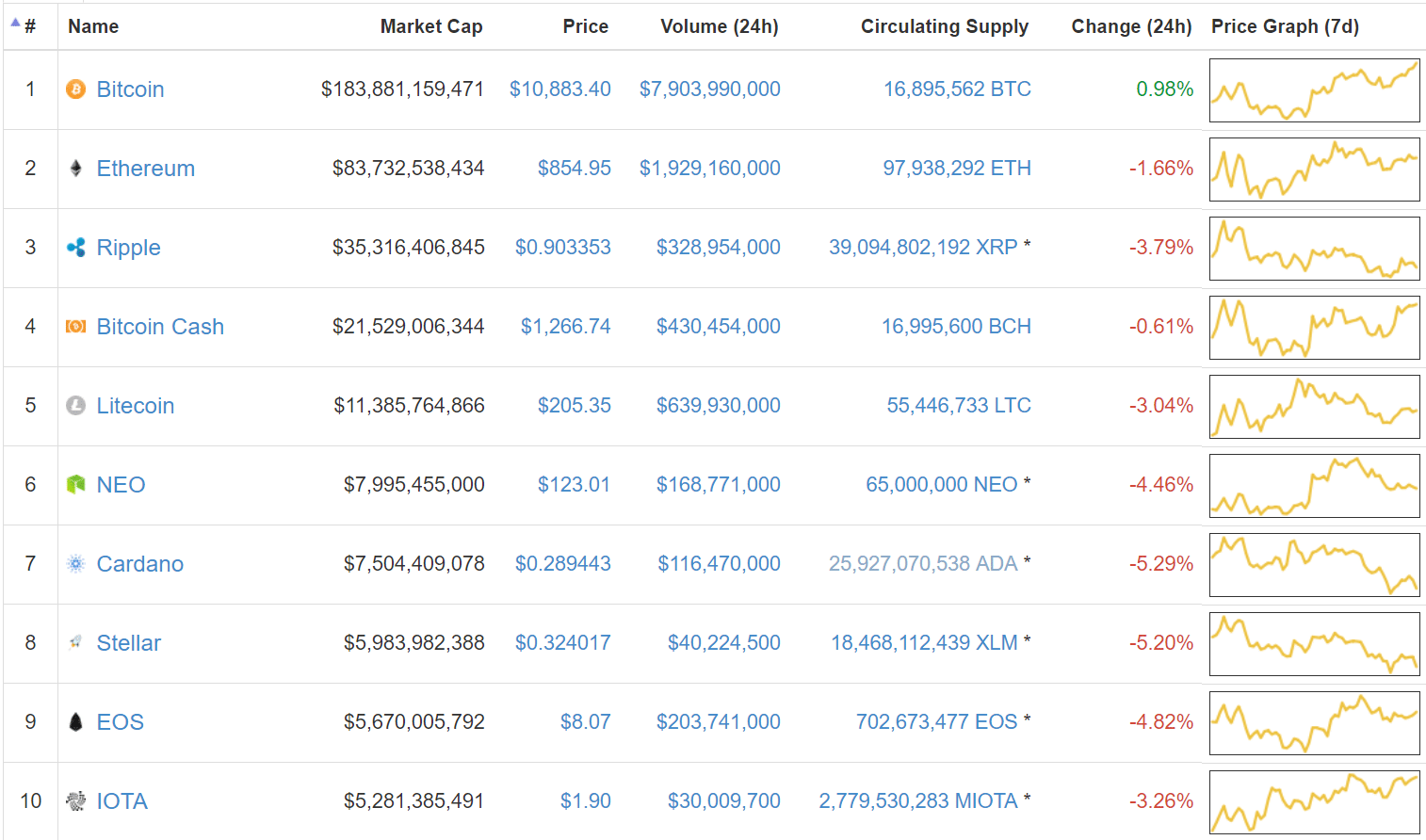

Like a phoenix rising from its ashes, the cryptocurrency market is in the midst of a resurrection, but is there enough wind under its wings to make it take flight? Over the week, we had a bit of a scare as Bitcoin failed to break the $12k resistance and dropped back down to $9.4k. It’s back up now, however, but not all the way back. As we approach $11.5k and possibly $12k once again, keep an eye on buying power; if there’s enough volume to push us over the previous resistance, we could be set to soar. Overall, the market is showing signs of life but it hasn’t been completely reborn yet. With an overall market cap of $455bln, it’s up a whopping 0.04% from last week.

Bitcoin: Big bird has gotten greedy with his share of the market again. Although it’s nowhere near the +80% we had at this time last year, Bitcoin’s market dominance is back to around 40%, the highest it’s been all year. The beginning-of-the-week dip set back Bitcoin’s price action a bit, but it’s still up 6% over the week with an asking price of $10,900.

Ethereum: As Bitcoin’s market dominance goes up, Ethereum is struggling to keep up in market share and price action. Crypto’s #2 currently wears a price tag of $855, an unfortunate 3% decline from its entry point into Friday of last week.

Ripple: Coming in at third (both for its rank in market cap and for its price movements this week) Ripple lost 11% of its value over the course of the week, currently priced at $0.90.

Domestic News

Bill Gates Says Cryptocurrencies Are Directly Killing People: “Right now, crypto-currencies are used for buying fentanyl and other drugs so it is a rare technology that has caused deaths in a fairly direct way,” the billionaire said. He adds that cryptocurrency is linked to terrorist funding, and he believes that crypto in the long-run is “super risky.” This change of heart is strange coming from Gates, who previously referred to Bitcoin as being better than fiat money in an interview on Bloomberg TV.

Financial Giant HSBC Embraces Crypto, JPMorgan Fears It: HSBC is in the process of launching live blockchain transactions into the business. “The technology has come a long way, we’re much more comfortable with its security and scalability,” HSBC Senior innovation manager Joshua Kroeker announced. On the other end of the spectrum, in a JPMorgan annual report released Tuesday afternoon, the bank stated that cryptocurrencies may add risks such as “delayed payment processing and other services.” Increased competition from tech startups will also force the bank to lower prices and fees, ultimately causing them to lose market share. Boo hoo.

$1 Trillion Money Management Firm Will Start Investing in Crypto: Boston-based firm Wellington Management Co. wants in on the action and is currently positioning portfolios with companies involved in mining and blockchain technology. For example, the company is already “investing in select chipmakers making components,” a good choice seeing how some manufacturers of chips have surged more than 30% since 2017. In addition, the company recently upgraded its systems to permit Bitcoin derivative trading.

Olympic Gold Medalist Skates His Way Into Blockchain: Apolo Ohno may as well be wearing bitcoin around his neck. While the skater put a lot of energy into winning a total of eight medals in the ’02, ’06, and 2010 Olympics, Ohno is now redirecting his focus on the new blockchain venture HybridBlock. The global exchange and learning platform will have its ICO in April and is expected to raise $50 million in funding.

CFTC Employees Officially Allowed to Trade Crypto: The United States Commodity Futures and Trade Commission has formally given its employees the OK to invest in crypto. CFTC general counsel Daniel Davis issued the permission in an email earlier this month following Giancarlo’s testimony before the US Senate. According to Giancarlo, employees will not be permitted to work on regulations for currency they are invested in for reasons of conflict of interest.

Billion Dollar Baby: Since Bitcoin’s Creation, the US Gov. Has Confiscated $1bln in Cryptocurrencies: Originally published as a report by Fortune, the US government has purportedly seized roughly $1bln worth of cryptocurrencies in raids on illegal activity, such as its arrest of Silk Road founder Ross Ulbricht. Usually, these assets are sold piecemeal in formal government auctions, attracting such notable buyers as Tim Draper in the past. You’d think that the rising price of cryptocurrencies over the years would make hodlers out of US officials. Second thought, likely not, as $1bln isn’t enough to touch (let alone put a dent in) the US national debt.

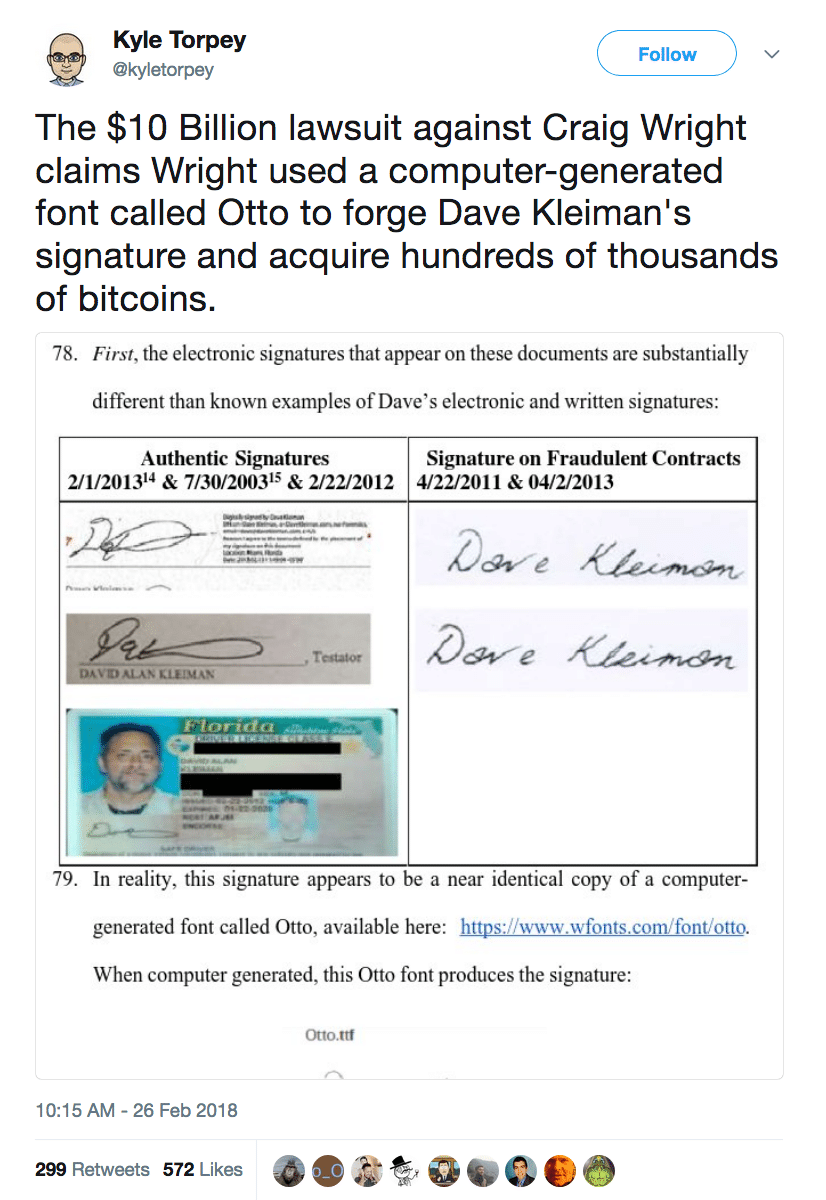

Pseudo Satoshi in Too Deep? Craig Wright Accused of Stealing $5bln in Bitcoin: The man who self-proclaims himself to be Satoshi Nakamoto, the creator of Bitcoin, is in a s*** load of trouble. Craig Wright is being sued in the United States District Court of the Southern District of Florida by a plaintiff representing the estate of David Kleiman. Upon Kleiman’s death, the plaintiff argues, Wright “forged a series of contracts that purported to transfer Dave’s assets to Craig and/or companies controlled by him. Craig backdated these contracts and forged Dave’s signature on them.”

Berkley, CA, Becomes First US City to Plan an ICO: Playfully dubbed an “Initial Community Offering,” the city of Berkley plans to launch its own ICO. Ben Bartlett, a Berkley City Council member, said that plans for the ICO were spurred on by the Republican Tax Bill pushed through Congress at the end of last year. The cryptocurrency will look to provide affordable housing to Berkley’s underprivileged, as homelessness is on the rise in the city and across CA as a whole.

What’s New at CoinCentral?

What is iExec RLC?: Decentralized cloud computing sounds like a beautiful combination of buzzwords used to hype up a product, doesn’t it? Don’t worry, iExec has substance to back up the buzz, and if this is the first time you’ve heard about the project, that makes sense–the team isn’t big on hype.

What is Counterparty (XCP)?: Counterparty is a platform for user-created assets on Bitcoin. It’s a protocol, set of specifications, and an API. Taken together, it allows users to create and trade assets on top of Bitcoin’s blockchain.

BitFlyer’s Hailey Lennon on Entering the US Market as a Bitcoin Exchange: Last week, Coin Central’s Steven Buchko had the pleasure of talking with Hailey Lennon, Director of Compliance at bitFlyer USA. They discussed Hailey’s jump into crypto, the current regulatory landscape, and how she sees regulation evolving over the next few years.

Doug Polk Crypto Lines Up Heavy Hitters for New Podcast Channel: Our very own Doug Polk now has a cryptocurrency podcast to supplement his ever-popular YouTube channel. On the podcast, Doug discusses all things crypto, from technicals to current happenings, with notable guests in the industry.

NEO Airdropping ONT Tokens to Community: In this article, we explain how to get some of these “free” coins via the airdrop.

Chinese Online Retail Behemoth JD.com Launches Blockchain Accelerator: Learn more about this Chinese retailer with more than 266 million customers and over $100 billion in gross merchandise.

What is Blocknet (BLOCK)?: As you probably know, there are hundreds, if not thousands, of blockchains that currently exist. Blocknet is connecting the isolated blockchain systems that currently exist to create one, cohesive ecosystem.

What is Monaco Card?: Monaco Card is a Visa-branded debit card that draws from a cryptocurrency-funded bank account. Since it’s a Visa card, you can use your Monaco card just like you would any other card.

Goldman Sachs-Funded Circle Purchases Poloniex For $400 Million: Just another day in crypto: Circle Internet Financial Ltd. recently announced its acquisition of Poloniex for the cool price of $400mln.

Leaked Emails Seemingly Exonerate IOTA of Alleged Vulnerabilities: This leaked conversation pulls back the curtain of IOTA’s alleged vulnerability.

What is Polymath?: Polymath simplifies the legal process of creating and selling security tokens. It makes a new token standard, the ST20, and enforces government compliance.

What is Nexus(NXS): What exactly is Nexus? Find out why Nexus may just be one of the few projects still in action 20 years down the road.

What is Santiment (SAN)?: Still in its early days, check out the all-in-one feed source of objective cryptocurrency information that includes unbiased news, project analysis, and a boatload of other data.

NEO First Project to Break into Weiss Ratings A-Tier: The Chinese-based blockchain platform and cryptocurrency NEO is the first project to break into the A-Tier, as dictated by Weiss Rating standards.

What is Ubiq (UBQ)?: Find out how this project intends to stabilize blockchain technology for use in enterprise.

What is Nav Coin?: Learn more about the interesting work in the private payments and anonymous dApps space this project is doing.

What is Syscoin (SYS): Is this decentralized marketplace the next Amazon? Take a look at Syscoin, blockchain’s answer to e-commerce platforms.

[thrive_leads id=’5219′]

Cryptocurrency News from Around the World

In Deutschland, Crypto Is Now Legal Tender (for Tax Purposes): Deriving its decision from a European Union Court of Justice ruling on value-added taxes, Germany’s Finance Ministry published guidance for their stance on cryptocurrencies this past Tuesday. Its stance indicates that for tax purposes only, cryptocurrencies will be treated as legal tender. This is in direct contrast with the United States’ treatment of crypto, which says, in effect, all crypto assets are recognized as property.

Singapore Eyes Regulations to Protect Investors: Singapore’s central bank (The Monetary Authority of Singapore) is questioning whether or not it needs more regulations in order to protect investors. Aiming to become a hub for cryptocurrency, the city-state does not regulate digital assets in the hopes of bringing tech companies to the area. However, the central bank does impose regulations on digital assets if they pose inherent risks, and is “assessing if additional regulations are required for investor protection.”

Toronto-Dominion Bank Joins the Ban-wagon, Blocks Crypto Purchases with Credit Cards: Taking a cue from its American and British peers, TD is tip-toeing around credit card use for cryptocurrency purchases. The Canadian-based bank made the announcement on February 23rd, a move that comes on the tail-end of the Royal Bank of Canada clearing debit/credit card purchases of cryptocurrencies (while warning citizens of inherent investment risks, of course).

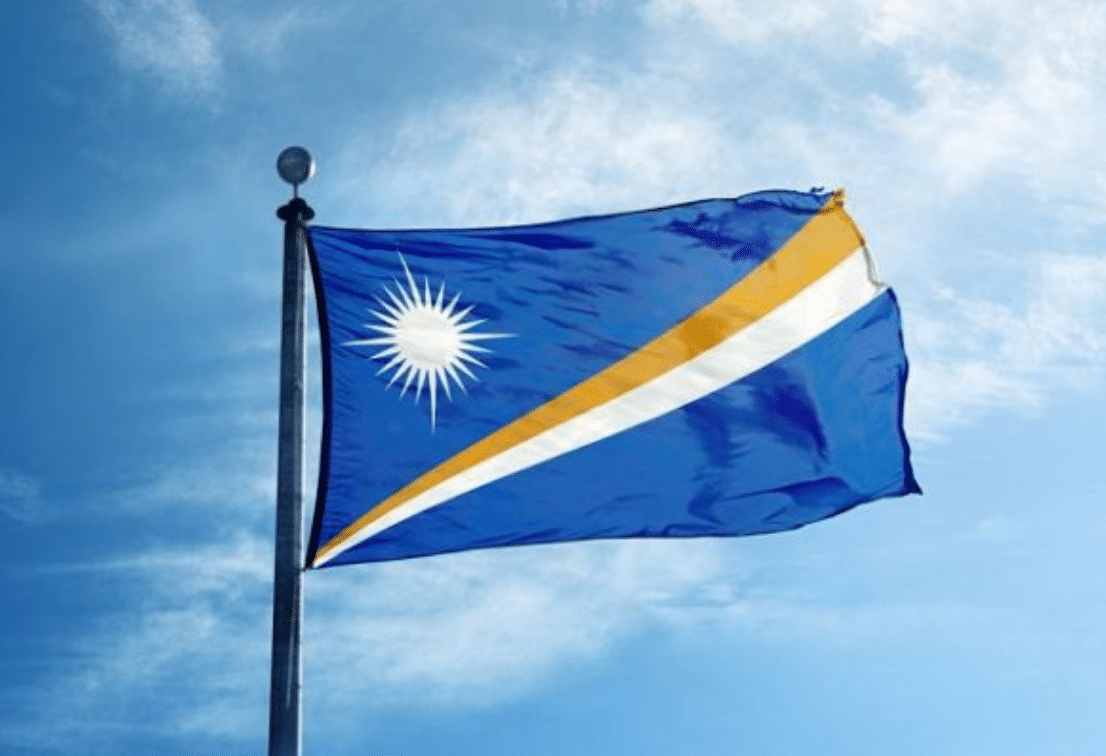

The Marshall Islands to Launch Its Own Cryptocurrency: Branding their coin as the Sovereign, The Republic of the Marshall Islands plans to launch the digital asset this year and have it function as legal tender. “This was specifically targeted for the long-term needs of the country,” said David Paul, minister-in-assistance to the president. Around 70,000 people inhabit the more than 1,100 islands that make up the country. The move follows in similar fashion to countries like Venezuela, who hope that government-run digital currencies will help strengthen their economy.

This Just In: Borderless Financial System Being Used to Bypass International Sanctions: Anyone surprised? Media scrutiny has continued to pick at the ways in which unscrupulous country heads have turned to cryptocurrencies to fund their regimes and circumvent sanctions. We’ve seen this very blatantly with Venezuela’s newly-launched petro, a cryptocurrency that President Maduro has, more or less, admitted is meant to dig the country out of the economic pits of disaster. In the Eastern Hemisphere, Russia looks to mint its own national cryptocurrency, the crypto ruble, and North Korea is still under international scrutiny for seemingly funding hacking attacks against South Korean exchanges.

Austria’s Finance Minister Wants the EU to Treat Crypto Like Gold, Other Derivatives: Hartwig Löger, Austria’s Finance Minister, met with his Portuguese counterpart Mario Centeno this week to discuss potential regulations the EU might adopt towards cryptocurrencies. Coming out of the meeting, both ministers found that basing regulations on rules dictating gold and derivatives trading may lay a responsible groundwork for reducing fraud, money laundering, and terrorist funding–areas the cryptocurrency realm is all too familiar with.

China Takes On Big Brother Role as Police Monitor Overseas Crypto Activities: In a report by Chinese news outlet Yicai, Chinese authorities have taken notice of people “moving their servers offshore or registering companies overseas” in order to evade regulations. Being such, officials will review domestic bank accounts linked to those “suspected of helping domestic investors to make digital currency transactions at overseas exchanges.” The report is unsurprising, as China has been one of the harshest critics of cryptocurrency with its ongoing attempts to ban it.

1% of Global GDP Will be Affected When Bubble Bursts: In an interview with Business Insider on Feb. 27, Goldman Sachs chief investment officer Sharmin Mossavar-Rahmani said when the crypto bubble bursts, “only” 1% of the global GDP will be affected. Those invested in crypto “will get hurt… But it’s a very, very small part of global GDP.” She says that while crypto is a “hot topic” right now, cryptocurrencies in their current form won’t last.

*Erin Gorsline coauthored this post*

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.